Property tax Singapore

These kinds of properties will continue to be tax at. Web Property Tax is a tax on the ownership of immovable properties in Singapore.

![]()

Real Estate How Will Property Tax Increment Impact Housing Market

2023 Property Tax Bill.

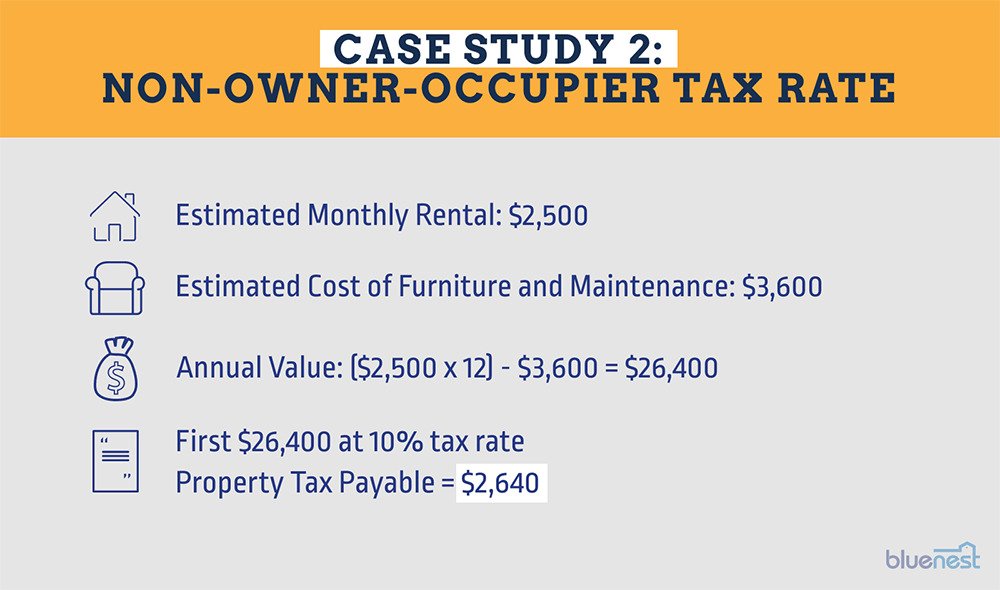

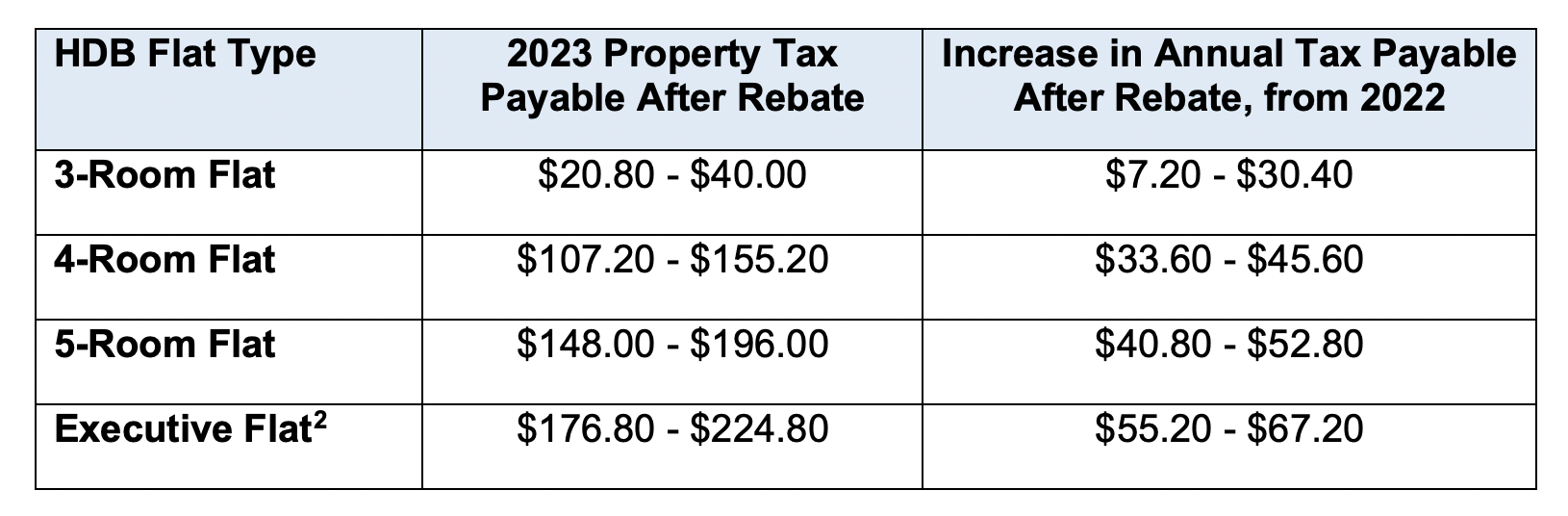

. Web This will be automatically offset against any property tax payable in 2023. If you do not. Web How to Calculate Property Tax in Singapore The IRAS property tax payable is calculated with this formula.

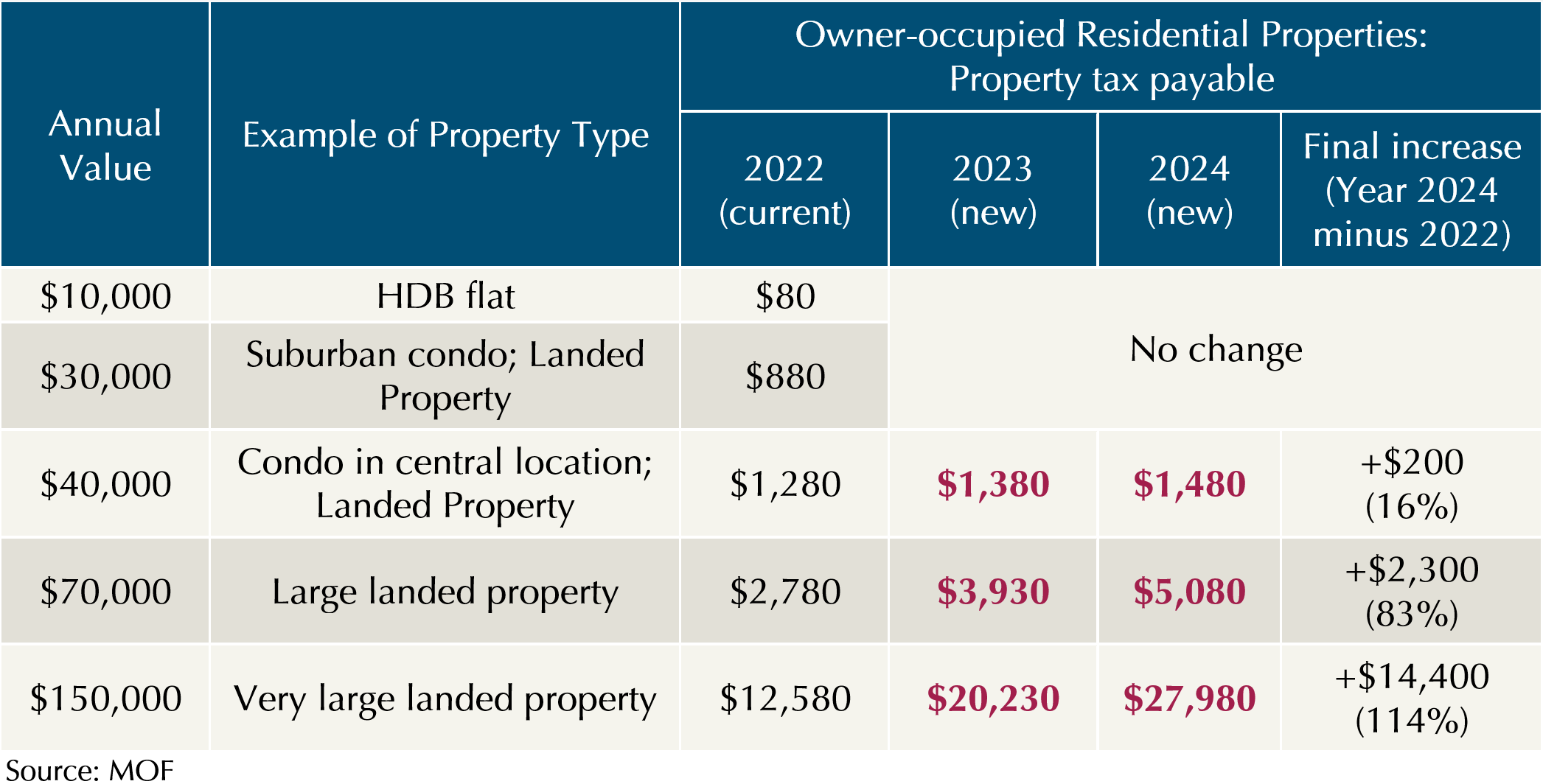

Web The Budget 2023 property tax announcement is expected to raise Singapores property tax revenue by 500 million per year. Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. Property Owners Go to next level.

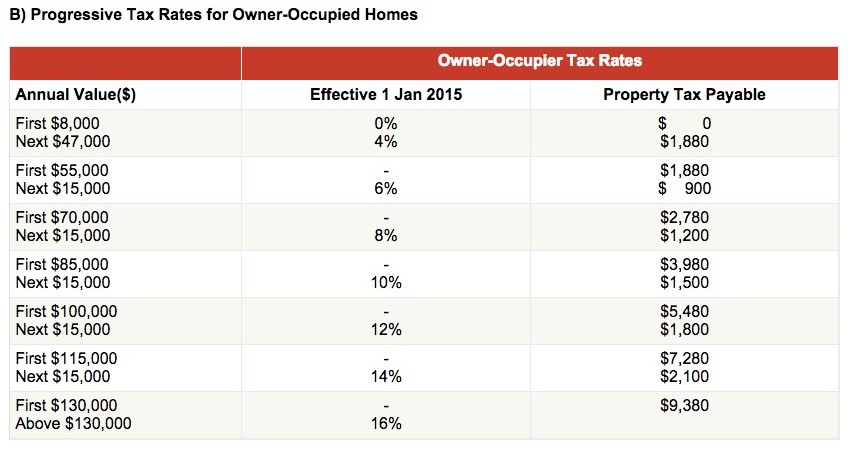

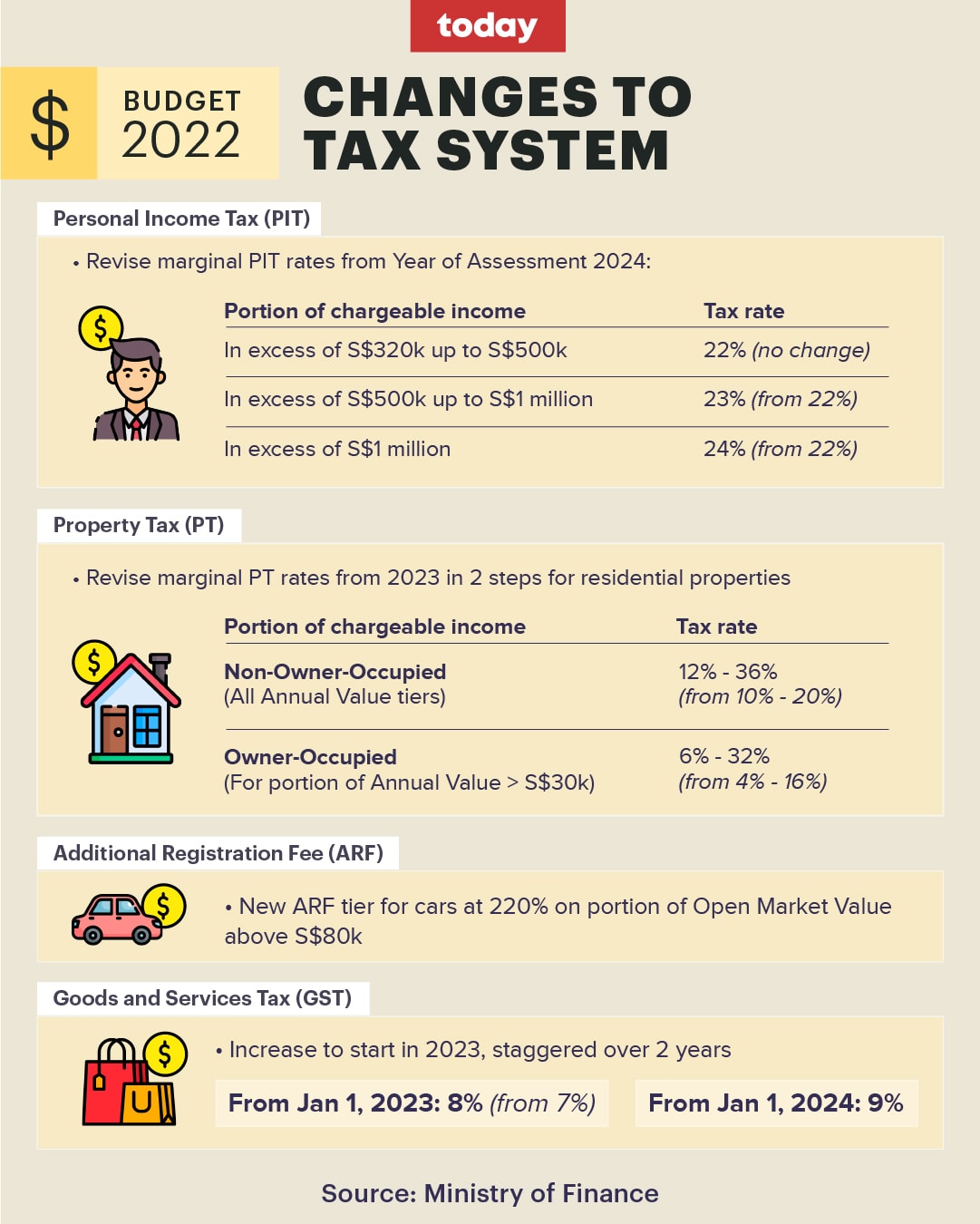

19 Feb 2022 0537AM SINGAPORE. For example if the. Web 1 day agoThe property tax for owner-occupied residential properties was raised to 5 per cent to 23 per cent from 2023 and 6 per cent to 32 per cent from 2024 for the portion of.

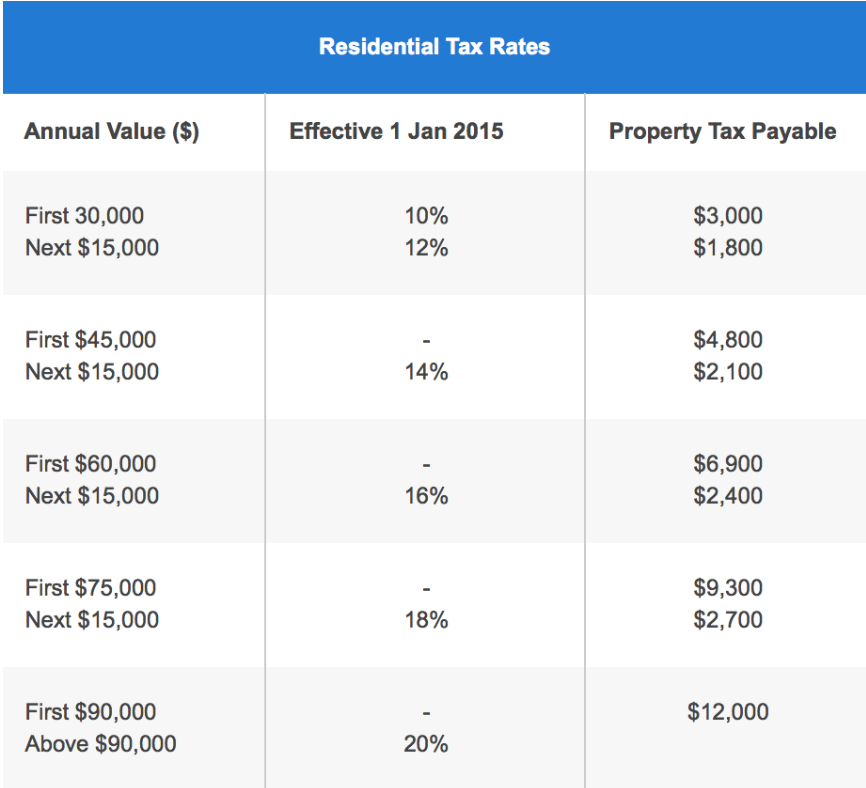

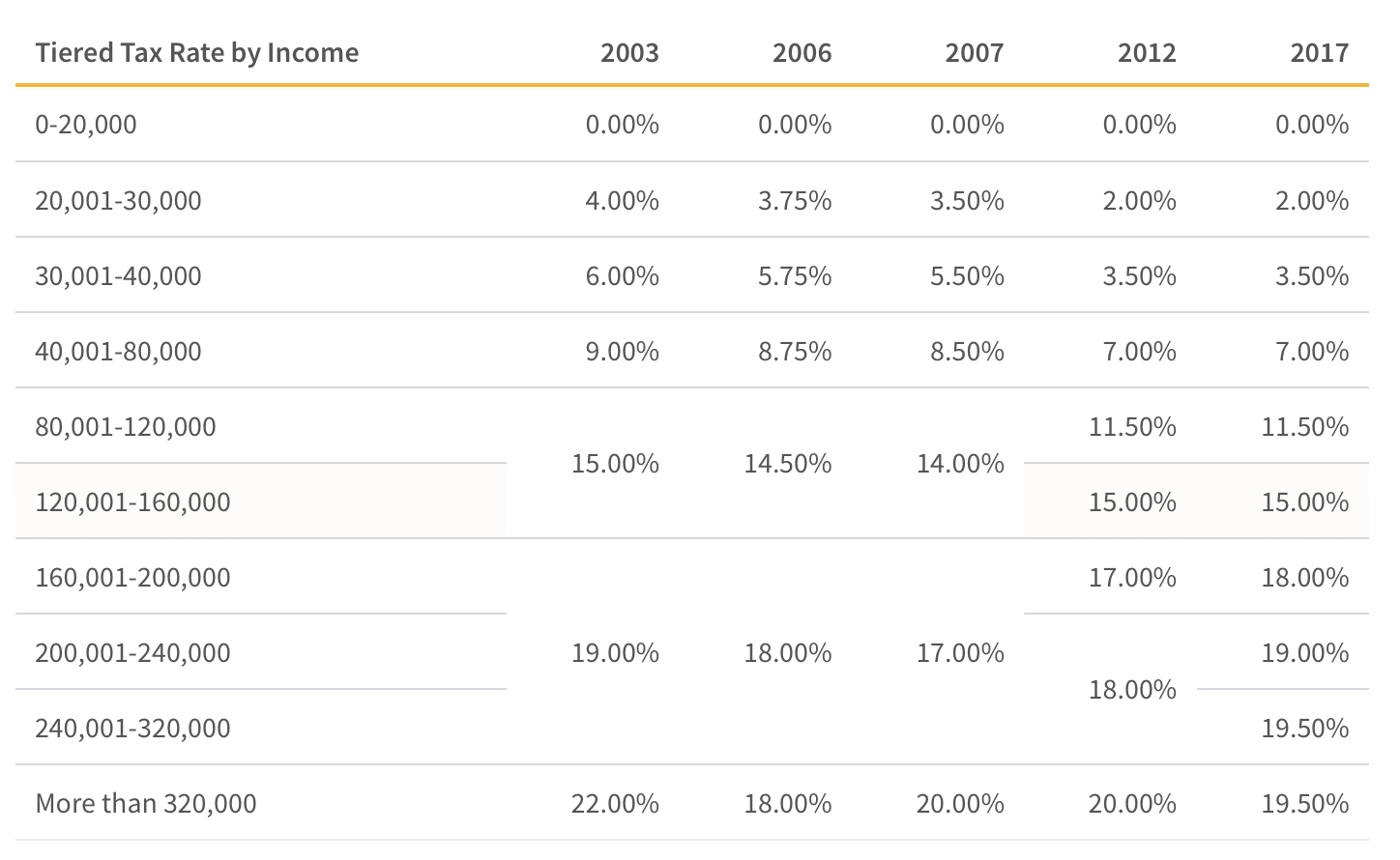

Singapore will be raising the personal income tax rate for top-tier earners alongside. Property Tax At A Glance. Web The above tax rates apply to non-owner-occupied properties except for those in the exclusion list specified by IRAS.

Web 5 hours agoA home that costs S10 million will now have this stamp duty of S539600 which is a 403 per cent jump over the S384600 now. Web Check Property Tax Balance. Web Singapores budget for 2023 presented 14 February 2023 includes the following proposed tax measuresfrom enhanced tax deduction schemes to progressive.

Web For added security email your case-specific enquiries via myTax Mail on myTax Portal using your Singpass Singpass Foreign user Account SFA or Corppass. Web The final tax rates of up to 36 per cent for non-owner-occupied homes or 32 per cent for owner-occupied residential properties will take effect for tax payable from. Annual Value AV x Property Tax Rate.

Web 18 Feb 2022 0524PM Updated. Mr Nicholas Mak head of. A rise in the buyers stamp duty BSD announced in the Budget on Tuesday Feb 14 will affect mainly high-end luxury properties property agents and.

One- and two-room HDB owner-occupiers will continue to pay no property tax next year. It applies whether the property is occupied by the owner rented out or left vacant. This service enables you to enquire the property tax balance the payment mode of property in the Valuation List.

Web Check Property Tax Balance This service enables you to enquire the property tax balance the payment mode of property in the Valuation List. For example if the. According to Dr Lee Nai Jia.

Web Property tax formula Annual property tax is calculated by multiplying the Annual Value AV of the property with the Property Tax Rates that apply to you. Web 1 day agoSINGAPORE.

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

Singapore Budget 2022 Highlights On Personal Finance Providend

A Simple Guide To Singapore Property Tax Biz Atom

Property Tax Singapore 2022 Increase Majority Of Hdb Flat Owners Will Pay More Property Tax Next Year

Property Tax In Singapore 2021 A Guide To Calculating The Rates Financeguru

How Do I Check My Property Tax Singapore 2022 Guide Bluenest Blog

Budget 2022 Singapore S Wealthy To Pay Higher Personal Income Tax And Property Tax Today

Property Tax In Singapore Know What To Pay And Save

Mof Press Releases

Understanding Property Tax In Singapore Sg Luxury Condo

Lower Property Tax In 2016 Lush Dream Home

Property Tax And Permanent Residence In Singapore

Complete Guide To Property Tax For Homeowners In Singapore

Consumer Taxes In Singapore Trends Analyzed Valuechampion Singapore

Property Tax And Permanent Residence In Singapore

Blog Klaus Und Partner Steuer Und Recht

What Is The Annual Value Of A Property And How Do I Check Mine 99 Co